In the world, 2.5 billion people have no access to a credit score, bank accounts, or formal documentation. That is a third of the world’s population! If these people want to take a loan, their options are limited. They could take a micro loan (which usually only go up to $150), however the process can be very difficult as a group of people must vouch for you, and only business owners can get them (Hayes, 2015). If more money is needed, or if the loan is for a personal issue such as unexpected large medical bills, a loan shark is the only option left. This is not only illegal and dangerous, but also the interest rates usually go up to 300% (Siroya, 2016).

2.5 billion people have no access to a credit score, bank accounts or formal documentation

Varied companies and individuals have aimed to help such people access the investment they need. Examples include social crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe, and person-to-person loan arrangements sites like Kiva. However, many depend on the charity of those in better conditions, who choose who to support. For the individual or smaller business owners or people interested in personal loans these sites often do not provide the solution they need.

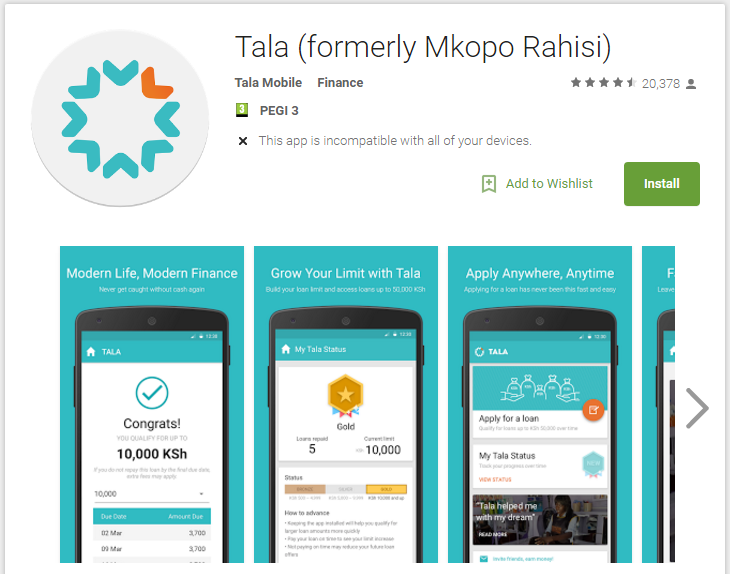

In through the door comes Tala. It is an application developed by InVenture which aims to redefine loan provision in the third world. How is it planning to do so? Tala users will answer a few questions in order to be analysed by their system and see if they are eligible. These answers, together with more than a thousand data points like the ones showed below, are used as predictors for their repayment rates.

Today, Tala has reached more than 200,000 loans in Kenya in the last year, and their repayment rates have risen above 90% (Siroya, 2016).

Additionally, users can build up their credit score with Tala in order to apply for larger loans in commercial banks in the future, something that was not a possibility before. While for the moment Tala is only active in Kenya, it will hopefully redefine the credit industry in the third world.

References

Adam Hayes, C., 2015. What Is Microlending And How Does It Work?. [online] Investopedia. Available at: <http://www.investopedia.com/articles/personal-finance/040715/what-microlending-and-how-does-it-work.asp> [Accessed 14 Sep. 2016].

Anon, 2016. Tala – Instant credit for a modern world. [online] TALA. Available at: <http://tala.co/> [Accessed 14 Sep. 2016].

Falcon, A., 2016. 10 Crowdfunding Sites To Fuel Your Dream Project. [online] HKDC. Available at: <http://www.hongkiat.com/blog/crowdfunding-sites/> [Accessed 14 Sep. 2016].

Siroya, S., 2016. A smart loan for people with no credit history (yet). [online] Ted.com. Available at: <https://www.ted.com/talks/shivani_siroya_a_smart_loan_for_people_with_no_credit_history_yet/> [Accessed 14 Sep. 2016].

First of all thank you for your interesting article. I share your hope that Tala could substantially reduce poverty in third world countries.

However, I do think that achieving this goal can be rather difficult. Although building up the credit score enables users to apply for larger loans, the loans are not sky-high in the beginning, and hence resemble microfinance to a certain extent. Microfinance has proven successful in some occasions; however, there is a substantial amount of articles that show the negative side of microfinance. For example, in ‘Microfinance Misses Its Mark’ (http://ssir.org/articles/entry/microfinance_misses_its_mark), Aneel Karnani discusses that microfinance is more beneficial to people living above the poverty line as opposed to living under the poverty line as people under the poverty line are not willing to take risks by e.g. investing in new technology with respect to richer borrowers. It appears that the best way of getting people out of poverty is steady employment with reasonable wages. How do you think Tala is different from this trait of microcredit in the earlier stages of borrowing?

Moreover, Tala now is compatible with M-Pesa, a (fantastic) mobile-based banking system that is of key importance in Kenya and Tanzania in particular. If M-Pesa is not active in a particular country, Tala can’t enter the market in that country. The reliability on M-Pesa might also prove to be difficult.

All in all, I would like to thank you once more for introducing this topic, and I hope like you that Tala (or comparable systems) will be a positive change in the credit industry of the third world.

Hi, thanks for your comment!

Indeed the loans in Tala are small in comparison to those in other countries, but it’s upper limit is larger than most microloan offers, and it can be used not only for business growth but also personal emergencies like unexpected medical bills. Also, while someone under the poverty line may apply and receive credit from Tala, it is unlikely that they receive it, as one of the base requirements is a positive savings or income, even if it is a small or unstable one. Indeed, if they are eligible for a loan, it is an issue to convince these people to take the risk. This may be one of the reasons that they have only given around 200,000 loans within their first year, a number very small if you consider the size of the population in Kenya.

I also agree that it is an issue that it is only compatible with M-Pesa. Hopefully in the future it can integrate with other (more secure) platforms. At the least, there is hope that it encourages other organizations to provide more stable solutions for the improvement of billions of lives without relying on charities.

Thanks for your article, I’ve seen the same TED talk a couple of weeks ago and it all sounded like a very idealistic idea to open up this market – while charging >10% interest (!).

Both of you haven’t addressed a major issue in my opinion and that is privacy.

After installing and logging in to the app, it will ask for two very privacy invasive permissions in order to start collecting the data needed to generate the credit score. The first one is to “read your text messages (SMS or MMS)” and the second one to “read your call log”. If this would be clearly explained and asked to user, one could say that it is the user’s own responsability and choice. However, this is not the case with Branch as they only state to use data on a user’s phone. This is also one of the reasons why they only have an Android app. Apple, for example, does not allow an app to access and read user’s SMSs, making this privacy invasive credit rating method impossible.

Lastly, another problem I have with this initiative is the start limit of only Sh. 1000 (9.87 USD). How is that ever going to change a person’s life?

I’m looking forward to hear your view on this major privacy concern I just described.

Source: http://www.biasharainsight.com/2016/01/branch-app-review/

Hi,

Firstly, while your article is indeed very insightful on the negative implications of using Branch and similar applications, this article is related to Tala (Mkopo Rahisi), and as is stated in the very article you reference, unlike Branch they do indeed declare in their privacy policy that they take this sort of information. However, it is indeed an issue of concern if despite this information disclosure, users do not know yet the information they provide. With that in mind, I will consider your other points.

Since you watched the Ted Talk, you may remember that the CEO of Tala discussed in more detail how some of the data points they use to calculate the trustworthiness of applicants are obtained through access to SMS and Call log information in order to get a better idea of their customers, as they do not have conventional means to do so. While for us in Europe, data privacy may seem like a strong issue, perhaps someone experiencing a different reality will not think twice about giving up privacy to obtain a loan. This may sound cynical, but I don’t view Tala as an ideal solution. Rather, I see it as an initiator of a shift in how we think about aiding the economic growth of those in poverty situations.

Secondly the 10% interest and small initial loan is based on the fact that Tala does not have conventional means to analyse if a customer is trustworthy or not. Tala has no strong statistic data through which to measure the reliability of its customers, as (again) they do not have credit history, stable income or savings to back up the promise they will pay back their loan. Also, this is not a new concept. In other more conventional banks, new customers also have lower limits and higher rates when they begin.

10 dollars will not change a person’s life, but giving them the chance to prove they can pay it back and building up a ‘credit score’ with Tala will allow them to reach higher amounts in the app and later on in larger conventional banks. Without options like Tala, they would have no other choice.

These points highlight how important it is to provide people with an option to improve their lives. While it is not an immediate free ticket out of poverty, it is much better than their current options will ever get them. While I do not agree that privacy of data is a large concern in this scenario, thank you for your comment. To discuss how these initial models can be improved is what is necessary to provide a better solution.