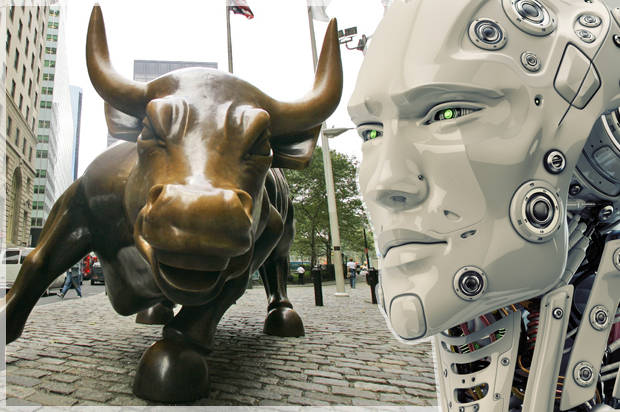

Due to lacking performance and increasing scrutiny regarding management fees, hedge funds are experiencing massive outflow of capital. To increase performance and to get an edge in a super competitive financial world a growing number of big investment firms and hedge funds are adopting artificial intelligence (AI) technology.

AI has become a more frequently sided technique of investing next to quantitative and human based investing in the hedge fund world. Nowadays the majority of human based investing hedge funds get help from computer models to make investment decisions and approximately 9 percent of all hedge funds are quantitative based funds. The latter manages about $197 billion in total. Quantitative based investing involves data scientists or “quants” in Wall Street terms, using machines to build large statistical models. These models are complex, but also quite static. As the market changes, they may not work as well as they worked in the past. This is where AI outperforms as it is a flexible model. But despite that, it is not so easy to tell the difference between AI and quantitative based investing. Both methods are dependent on computers and huge amounts of data to make investment decisions. What distinguishes AI from quantitative investing besides flexibility is that AI itself is also learning and that it tries to improve itself over time as it gains more and more experience at its function. On top of that AI is also capable of finding trades that humans can’t. This is because computing is getting cheaper and more accessible. Algorithms have become more complex and capable of taking advantage of this immense accessible computing power. Furthermore, data is more available than ever before. These factors explain why machines are far better and faster than humans at identifying patterns and trends in data. For example: monitoring book orders, lists used by traders that show interested buyers and interested sellers of securities including their asking and bidding prices, is better done by computers as they can rapidly detect patterns of behavior in these books that humans could easily miss. And therein lies the power of AI right now. Today’s AI is better because it has more and better information than ever from which to learn. As the volume of available data grows, it provides more chances for artificial intelligence to become the dominant way of investing (Freedman, et al., 2016) (Wigglesworth, 2016).

One of the current problems for AI based funds is that they have no real world track record and therefore struggle in attracting big capital. But as time continues more and more AI based funds have somewhat proved they can perform. As a result, over the past three years’ investments in AI based funds have tripled from 700 million to 2.4 billion dollar. The biggest AI funds reached a 12% positive return this year. Even in Japan, which has one of the most volatile markets, AI investing methods reached a 2% positive return. One specific example of how an AI fund-management program outperformed the market is Japan based Nomoura. During the months of political polling around Brexit many traders in japan signaled that the “remain” side would prevail. But Nomoura’s AI program initiated trades that day that went against the prevailing sentiment of human traders in Tokyo. Nomoura embraced himself for impact as he thought all went to hell. But when the day ended and citizens of Britain voted to leave, markets in Japan tumbled and Numoura’s fund was up 3% (Cawley, 2016).

Even though cases like this give way for a bright future for AI there are still serious hurdles. One of the future problems for AI investing is that even if one fund achieves success with AI, the risk is that others will duplicate the system and thus undermine its success. Subsequently If a large portion of the market behaves in the same way, it changes the market by making it either more volatile or by making it more fixed, making market conditions less favorable. It furthermore could mean only a handful of companies that successfully employ AI based funds survive and that financial oligopolies or monopolies arise. This subsequently could result in an increase in inequality as more and more capital flows to the people who designed the surviving programs and the ones investing in it (FLeury, 2016).

Wheter AI will become a success on Wall street is for the future to decide but what is defined is that it will become more dominant in the financial world.

Bibliography

Cawley, C., 2016. Tech.co. [Online]

Available at: http://tech.co/artificial-intelligence-investment-tripled-2016-07

[Accessed 25 September 2016].

Chu, K. & Ho, K., 2016. Bloomberg. [Online]

Available at: www.bloomberg.com/news.artiles..2016-08-21/hedge-fund-robot-outsmarts-human-master-as-ai-passes-brexit-test

[Accessed 25 Septermber 2016].

FLeury, M., 2016. BBC. [Online]

Available at: http://www.bbc.com/news/business-34264380

[Accessed 25 September 2016].

Freedman, R., Klein, R. & Ledermand, J., 2016. Artificial Intelligence in the Capital Markets: State-of-the-Art Applications for Institutional Investors, Bankers and Traders.. Mcgraw Hill, Volume 1994.

Wigglesworth, R., 2016. Financial Times. [Online]

Available at: https://www.ft.com/content/9278d1b6-1e02-11e6-b286-cddde55ca122

[Accessed 25 September 2016].