The central bank digital currency is different from the encrypted digital currency designed and promoted by private organizations (such as Bitcoin)

The central bank digital currency (CBDC) has a similar use scenario to the encrypted digital currency designed by private organizations such as Bitcoin-both are stored and traded in electronic devices, but there is an essential difference between the two: the issuance of encrypted currencies such as Bitcoin It is based on a certain encryption algorithm, and the central bank’s digital currency issuance is based on national credit. Cryptocurrencies such as Bitcoin are decentralized, while central bank digital currencies are centralized-in China, the issuance of tokens by commercial institutions is even forbidden. In this sense, the central bank’s digital currency is not essentially different from traditional banknotes, and can be issued by the central bank. Accordingly, its currency value is generally more stable than encrypted digital currencies.

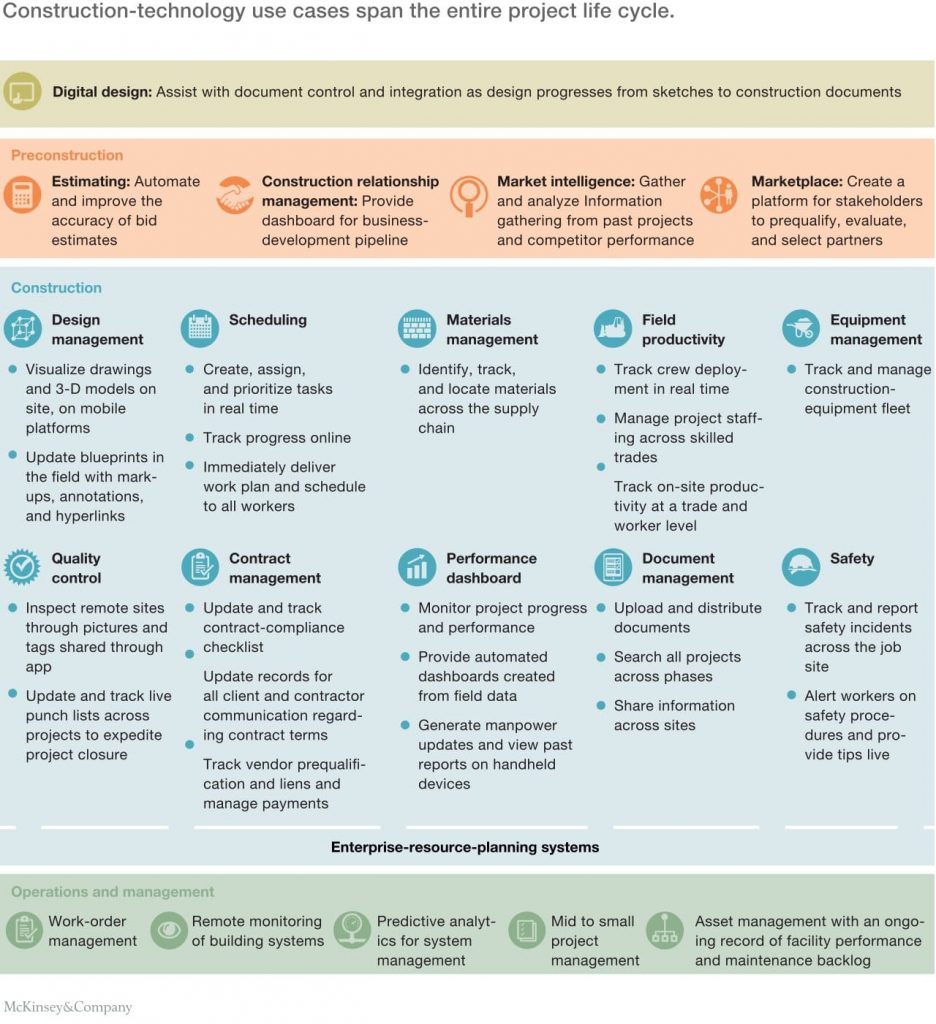

The central bank’s digital currency will transform the service form of financial institutions

Central bank digital currency is essentially the same as banknotes, but its medium of use is electronic equipment, so it is more convenient to use than banknotes. Users can deposit digital currency in the bank, and then directly trade through electronic devices. On the one hand, it saves the trouble of taking out paper money. On the other hand, it allows the bank to obtain more and more detailed transaction information, and the use of physical counters and ATM machines will be greatly reduced. For banks, the traditional offline marketing model may also be replaced, because there is a large amount of accurate user savings data, the bank can perform user portraits and then conduct business marketing more accurately.

Digital capabilities will become an important factor for financial institutions to compete in the market in the future

Why is digital capability more important for financial institutions? On the one hand, financial institutions with higher R&D technology priority can provide data interfaces with the central bank more quickly, and when the central bank issues additional currencies, they can seize the market faster; on the other hand, financial institutions with stronger data analysis capabilities Institutions will make it easier to improve the customer experience by interpreting the savings and investment of customers. According to a report by PANews, in the United States, the stock prices of cryptocurrency-friendly banks have risen faster with the increase in cryptocurrency trading volume.