Imagine powerful tech companies such as Google knew about every single item that you have purchased, both offline and online, in your entire life. Now skip the imagination, because if you were to use an online payment platform your entire life, they would.

As more and more people use online payment services for their own convenience, online payment platforms are fast gaining in popularity. One of such online payment platforms is Alipay. Alipay is a Chinese mobile and online payment platform that was created as the payment arm of the large Chinese eCommerce website called Taobao (Ant Group). With over 1 billion users, Alipay says they have created “an inclusive digital ecosystem accessible to everyone” (Alipay, n.d.).

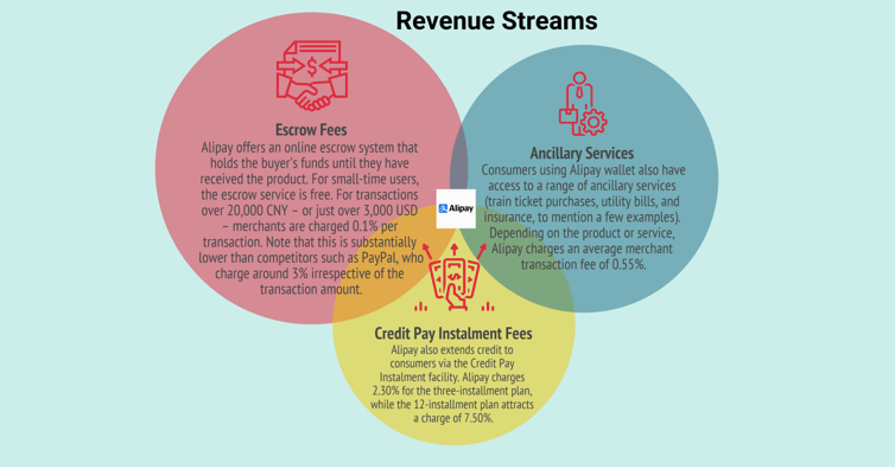

They make it sound great. Yet, there are concerns that Alipay is so dominant that no one can compete with them (Ovide, 2020). As a result, China decided to break up Alipay last month (Yu & McMorrow, 2021). To understand how Alipay can be ‘broken up’, it is important to first understand how Alipay operates. The image shows the revenue streams of Alipay (Cuofano, n.d.). As you can see, their revenues consist of escrow fees, also known as transaction fees, ancillary services and credit pay instalment fees. The latter refers to the highly lucrative lending business and is, not surprisingly, the part China wants to separate from Alipay.

In addition to separating Alipay’s lending business from its main business, officials have stated they want the separated business to have its own independent app. Notably, this would require Ant Group to turn over the user data that determines its lending decisions to a new credit scoring joint venture, which would be partly state-owned (Yu & McMorrow, 2021). The main reason being that big tech’s monopoly of power comes from their control of data, and China wants to end that.

Though it might seem just to control a company that becomes ‘too’ powerful due to possession of user data, it feels unjust that a government can restrict this way of operating by obliging an online platform to be split-up and most importantly, hand over the data.

This raises the modern dilemma on data: who is morally justified to take data ownership, and thus become powerful?

References

Alipay. (n.d.). Accessible digital payments for everyone. Retrieved from https://global.alipay.com/platform/site/ihome

Cuofano, G. (n.d.). How Does Alipay Make Money? The Alipay Business Model in a Nutshell. Retrieved from https://fourweekmba.com/how-does-alipay-make-money/

Ovide, S. (2020). Don’t Even Try Paying Cash in China. The New York Times. Retrieved from https://www.nytimes.com/2020/10/27/technology/alipay-china.html

Yu, S., & McMorrow, R. (2021). Beijing to break up Ant’s Alipay and force creation of separate loans app. Financial Times. Retrieved from https://www.ft.com/content/01b7c7ca-71ad-4baa-bddf-a4d5e65c5d79

Hi Myrthe, thanks for your concise explanation of revenue flow of Alipay and inspiring summary of the ownership of data. Indeed, no matter in the West or East, online payment has already taken part in our daily lives. While we enjoy the convenience of the technical mechanism, what we pay for the platform providers are more than the costs of products, but also offer them the value of data recorded with our preferences and personal profiles as bonuses. In China Alipay dominates the market, and thus the government tries to deal with the issue. However, other tech giants such as Google, Facebook, Apple in the free market may hold even more than half of human’s data but they provide competitive services which users are not easily to break up with. But does this mean government should be the savior or the data successor? Thus, I agree with your concern of data owner in the end of the article. For online platform users, it is surely an issue which closely related to our rights.

Hi Hsin, thank you for your comment! You are definitely right in adding that other tech giants may hold much more data than online payment platforms (also data is often shared between the parties), and nice to see we agree on the concern of data ownership. I also like how you make the clear distinction between competitive services users cannot easily break up with – or stop using – and payment platforms, though I do think that payment platforms are also becoming increasingly harder for users to break up with, as they dominate both online and in-store payments.

Hi Myrthe, thanks for your insightful contribution to the blog. I really like the way you analyse the case, combining data ownership, tech firms and the power of governments. Indeed it was a shock for Chinese investors when Ant’s IPO was suspended. To add on your article, it was mentioned in WSJ that the prospectus of Ant group was obscure about the complexity of the ownership, and the financing layers and investment vehicles of the group was opaque, which might be a threat to the government and the current financial system. This year in August, China passed the Personal Information Protection Law (PIPL), which lays out for the first time a comprehensive set of rules around data collection, mainly for tech companies. I agree that tech companies shouid not collect and store individual’s data without consents, but then to what extent our governments are using our data also worth investigating.

Hi Amanda, thank you for your valuable comment and for providing an interesting addition to the article! I definitely agree that the extent to which governments are using personal data should also be investigated.