The popularity of cryptocurrency has been increasing over the years. According to the global crypto adoption index, in 2021 there has been an adoption increase of 880%. Even institutional money and cash of huge firms have been added into the crypto market. Names like Blackrock, Tesla, PayPal, and Square are all examples of organizations that have adopted Bitcoin in some form. There are even rumors that Amazon will soon allow payments to be made with cryptocurrencies.

Although the increase of adoption has a positive effect on the future of cryptocurrencies, there is still one elephant in the room to be addressed that makes further adoption more difficult: the high volatility of cryptocurrencies. Perhaps today you could still use your bitcoin to buy a shirt, but the opposite could be true for tomorrow. To solve this problem, stablecoins like Tether and Binance Coin were introduced to the crypto scene by crypto organizations. The idea behind this special digital money is that it is pegged with fiat USD on 1:1 ratio, which means that one does not need to be worried about losing buying power in the short-term. Just like normal fiat money, the only way for stablecoins to lose buying power is by inflation. The question remains, however, how are these crypto organizations able to keep the stablecoins pegged on a 1:1 ratio with the USD?

In theory, stablecoin organizations are able to produce an infinite amount of stablecoins. But in order to be pegged with the USD on a 1:1 ratio, the same amount of USD must be owned by the stablecoin provider on their balance sheet. The problem is that many stablecoin organizations do not allow external auditing, which means that nobody knows if stablecoins are really backed by fiat money. Therefore, stablecoins could turn out to be a ponzi scheme. Another problem is the fact that stablecoins are rumored to be backed by bonds, some even of the almost bankrupt Evergrande, risking the intrinsic value of stablecoins. Although as of today both potential problems have not been proven yet to be real, it is clear that the use of stablecoins is still quite risky, making the coin potentially to be worth $0.

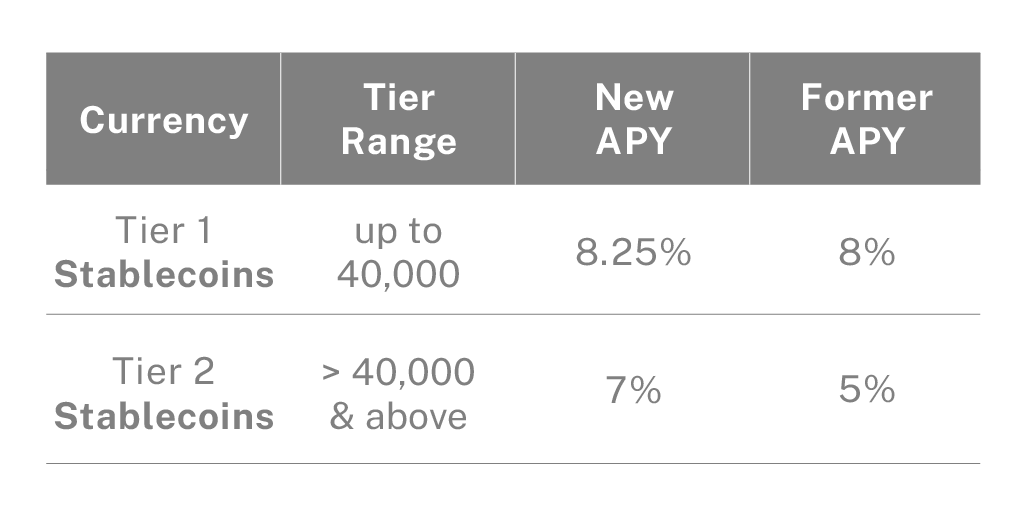

Interestingly, even with this risk in mind, there is still lots of demand for stablecoins. In fact, one could earn up to 8.25% interest if they store their stablecoins on crypto banks or crypto exchanges. Compare that with the interest rate of barely a percent by fiat banks, this seems like a great way for the normal people to earn interest on their savings. To good to be true? Maybe.

The reason for the high interest rate of stablecoins is due to the high demand of borrowing stablecoins by investors to speculate on the crypto market. Given the high volatility of cryptocurrency, this makes it possible for borrowers to have a high return of investment, using a part of their proceeds to fund the high interest rate. This concept is not new: fiat banks are doing the exact same. The only difference is that fiat money stored in fiat banks are insured by the government. In other words, if the borrowers are not able to pay back their debt, the government could still save the fiat bank and its customers with funding. The unregulated crypto banks and exchanges, however, are not insured, making it very risky to lend out stablecoins. Earning interest on stablecoins is thus high-risk high reward. Not to mention what could happen to the value of your lend out stablecoins once it is clear that it is perhaps a ponzi scheme. It was not a surprise when some governments are planning to come with their own stablecoins. China has done it.

To conclude, current stablecoins are not that stable as they seem to be. Not for daily use, and not for storing in your savings account. However, it is still quite useful for high-risk high reward investing strategies. Are you into that? Let me know in the comment section below.

https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index

https://www.cnbc.com/2021/07/23/amazon-is-hiring-a-digital-currency-and-blockchain-expert.html

https://ronaldmulder.medium.com/why-stablecoins-make-no-sense-999490b08910

Dear Kevin,

thank you very much for contribution. I clicked on your blog, thinking that it was about cryptocurrencies being volatile and that that was meant by stable coins. I, like many others, own crypto currencies and, although I know about crypto’s volatility, however, I am often still bewildered of how crypto rates can change in the matter of minutes. I was curious to see your perspective on this. Nonetheless, when reading your blog, I realised that it was about more than that. Actually, stable coins, in the sense of coins that mimic fiat money on a 1:1 ratio is a concept that is new to me. Therefore I want to thank you for expanding my knowledge in this respect.

I would describe myself as slightly risk-averse, although also investing in crypto. However, to me, the problem with these high-risk high reward investing strategies is something that you also stipulated in your article. The adoption is increasing dramatically. In the last year, an enormous increase is seen in the unique number of private investors. These investors are amateurs (like me) that make irrational decisions based on not being informed, driven by hot hand, and Gambler’s fallacies and using leverage to invest. It are these individuals who are behind the volatility (combined with ofc whales manipulating the market). This together with the lack of regulation are, in my opinion drivers, why I currently do not believe in stable coins and will not in the foreseeable future. As long as the coins are not regulated and checked properly, it is prone to indeed being a ponzi scheme, or having insufficient backing that can cause it to collapse. I do believe a lot of steps are being made in respect to this, however, I do believe that some (stable) coins will cease to exist before complete adoption and true stability can be reached.

Kind regards, Ralph