Just as card collections are being implemented on the blockchain as NFTs, there are also other industries that can capitalize from the adoption of blockchain, such as insurance, especially in developing countries.

Imagine you are a farmer in rural Africa, and you want to protect your crops against drought. Your options will be very limited as there are no or just a few local insurance companies operating in your area. Even if you buy one of the available policies and the drought occurs, the claim process is cumbersome and linked to tight reporting deadlines. Worst case scenario, you might even lose the documentation needed to submit for settlement (Adam-Kalfon et al., 2017).

To tackle this problem, insurance companies can use smart contracts via an underlying blockchain, which are also used to create NFTs, and offer blockchain-based insurance products to its customers. The smart contract automatically triggers the payout when the event encoded in the contract occurs. For instance, the insurance company sets a rain threshold of 3 months and if that threshold is surpassed, the smart contract triggers a pay-out event.

The Lemonade Foundation, one crucial stakeholder in the industry, already launched their blockchain-based crop protection in Kenya which allows farmers for as low as $0.83 to get their plot of land insured with a few clicks on their phone (Wininger, 2023).

When Prof. Ting Li asked the class who bought NFTs before, only three people raised their hand. Why is that and will the same happen to blockchain-based insurance products? There is a multitude of reasons which might explain the lack of adoption. For example, a lot of NFTs have to be bought via cryptocurrencies. Furthermore, older users tend to be less tech-savvy which creates a certain scepticism towards blockchain-based solutions. Nevertheless, I do not believe this applies to blockchain-based insurance products as users can pay in their local currency and the whole user experience runs on an app while having the blockchain-based infrastructure under the hood.

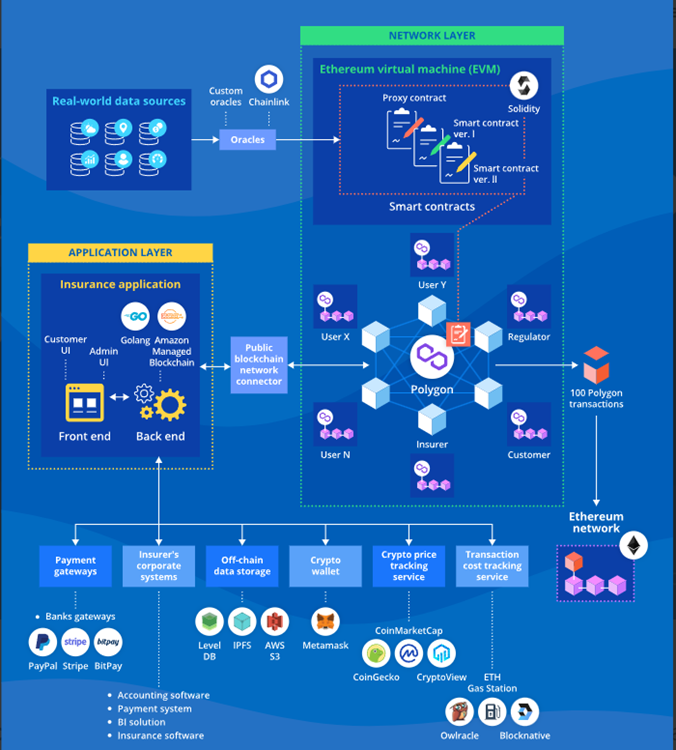

The figure below shows the types of architecture in a blockchain-based insurance industry.

References

Adam-Kalfon, P., PwC France, & El Moutaouakil, S. (2017). Blockchain, a catalyst for new approaches in insurance. https://www.pwc.ch/en/publications/2017/Xlos_Etude_Blockchain_UK_2017_Web.pdf

Smart Contracts in Insurance: A Complete Guide | ScienceSoft 🌐⛓️. (n.d.). https://www.scnsoft.com/insurance/smart-contracts

Wininger, S. (2023). Fighting World Hunger with Blockchain – Lemonade Blog. Lemonade Blog. https://www.lemonade.com/blog/lccc-world-hunger/

Thank you for your post! I knew blockchain could have many applications, but, to be honest, I never expected insurances would be one of them.

I agree that the blockchain smart contract triggers would make the insurance claim process be smoother, faster and with more guarantees. On the other hand, the cumbersome issues you mentioned with regards to application deadlines, documents etc. are some of the bad business tactics insurance companies use to try to avoid paying out money to people that are actually entitled to it. After all, insurance companies make money by not paying out the insurances :).

I am optimistic that, maybe, with some government regulation, blockchain technologies may put an end to these unethical business practices that insurance companies tend to make use of, as you presented in this post.

Very interesting blog. I read through the whole blog and I deduce that the blockchain here is private blockchain, because you didn’t set incentives for publics to record information, then only Policyholders could access the information of blockchain. And what intrigues me the most is that the way you want to generate insurance as NFTs (If I comprehended it correctly).

There are two insightful analysis for the lack of adoption, but I agree what you said later: there is no technical issue if we just use Dapps, and I also think NFT in this project is not required to be bought by cryptocurrencies. Maybe we can dig deeper about the reasons. I personally think that the blockchain didn’t be applied in insurance that much is that it has no much necessity. First, as you said, people don’t have much knowledge of Blockchain so far, and what value does it bring to company except bragging an idea that people don’t really know. The company can totally make an app with a automatic trigger mechanism to interact with real word, and don’t need to pay additional cost for blockchain. Maybe this application can grow as people’s increasing familarity to decentralization and trend of web 3, and I really hope this technology could apply more to our real life. Thank you again for the blog, which makes have more insight to blockchain.