Team 36: Pieter Quist, Stijn Ouwerkerk, Tijn van Breeden & Stijn van Leeuwen

The Dyme platform is passionate about simplifying personal finance. Over the years, it has built tools that allow users to track their spending, manage subscriptions, and gain financial insights. Now, as the fintech landscape evolves, so does Dyme. That’s why we’re proposing to integrate Generative AI (GenAI) into the Dyme platform to offer personalized, real-time financial advice, through the new DymeAdvisor.

Why GenAI?

Managing finances can be overwhelming, particularly when it comes to saving, investing, and paying off debt. Traditional financial advisors are often expensive, making expert advice inaccessible to many. Our AI-powered DymeAdvisor aims to solve this by providing personalized recommendations based on each user’s financial data, making it easier for everyone to make informed financial decisions.

What Will DymeAdvisor Do?

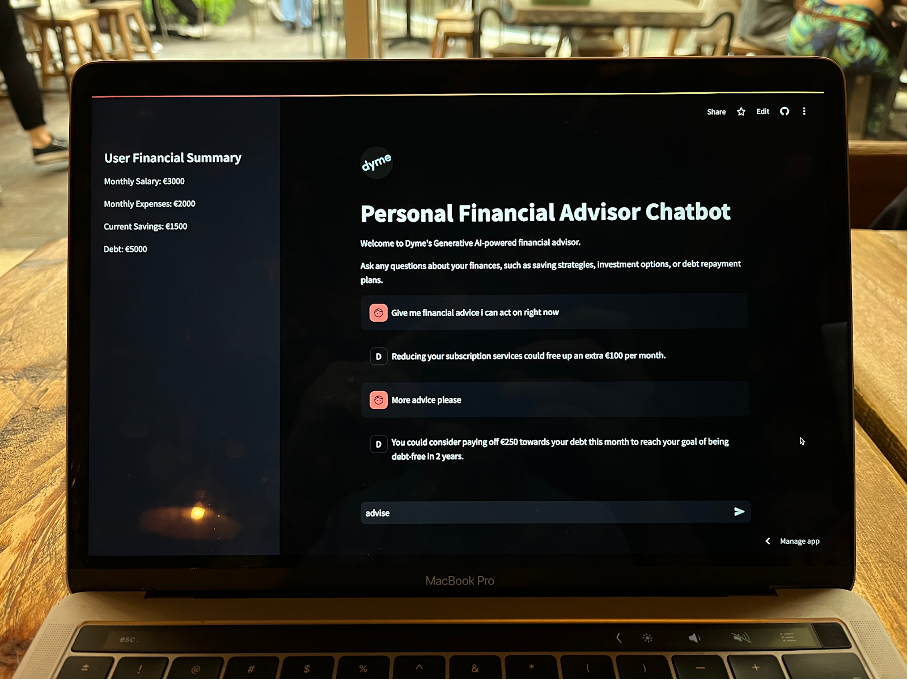

Our GenAI tool will offer personalized advice on saving, debt repayment, and investments. For example, it can recommend, “Based on your income and expenses, pay off €250 of your student loan to stay on track to be debt-free in 10 years.” This kind of insight allows users to make smarter decisions in real time, tailored to their unique circumstances.

Enhancing Dyme’s Value

With GenAI, Dyme will go beyond just managing subscriptions and showing spending overviews. The DymeAdvisor will offer 24/7 financial advice, giving users instant, personalized insights. This not only improves the user experience but also opens new engagement opportunities for those who may not typically seek financial advice. By enhancing customer interactions with AI-driven conversations, we aim to deepen relationships and improve customer satisfaction.

How We’re Doing It

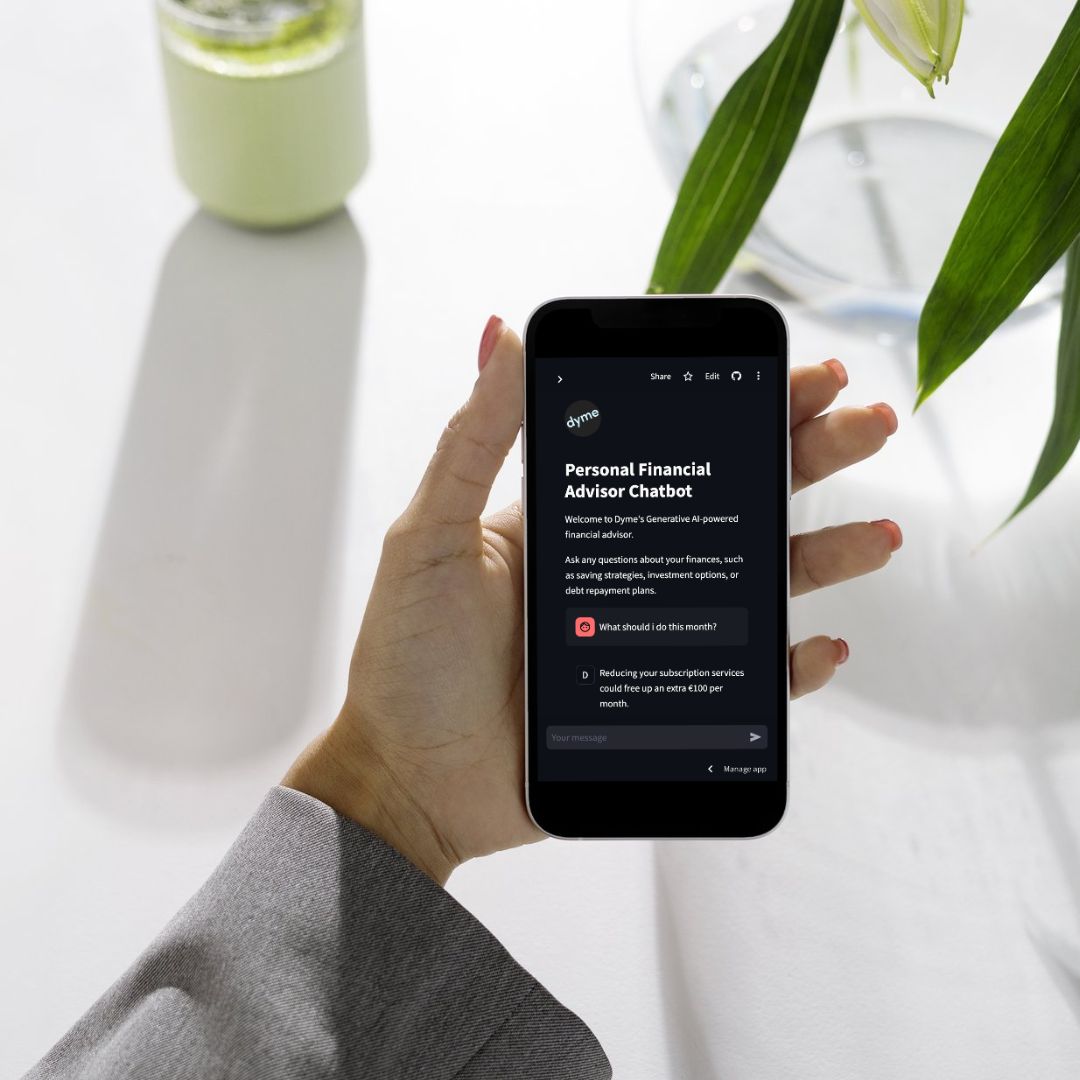

DymeAdvisor will be integrated as a chatbot within the Dyme app, allowing users to interact conversationally and receive actionable advice. We’re focusing on simplicity, usability, and trust to ensure that the AI is easy to use and accessible to all, whether users are managing debt or saving for their future.

What’s Next?

This is just the beginning. After launching a beta phase to gather feedback, we’ll roll out GenAI more broadly, potentially offering new premium subscription tiers for advanced financial advice. With this innovation, we’re taking a significant step toward making financial health more accessible and affordable for everyone.

Dyme believes in empowering users to take control of their finances. Our GenAI proposal is a key part of that mission, helping Dyme offer real-time, personalized advice to a broader audience.