Waiting three to five weeks for a loan approval feels antiquated in an era of instant digital services. Yet this is the reality for ING customers, a striking contradiction for a bank that pioneered digital banking in Europe (ING Groep N.V., 2024). With a €164.3 billion lending portfolio and advanced digital infrastructure, ING provides an ideal case for showing how Generative AI can resolve this paradox and help traditional banks defend against fintech disruption.

The ING Innovation Paradox

ING serves 8 million customers, 84% of whom prefer mobile banking, and invests €324 million annually in software (ING Groep N.V., 2024). Yet its loan approvals remain constrained by manual processes consuming 8–10 hours per application. Traditional workflows still require three to five weeks for decisions (McKinsey & Company, 2018).

Meanwhile, fintech competitors leverage automation for near-instant approvals. In the Netherlands, fintech lending doubled to €2.3 billion in just two years (De Nederlandsche Bank, 2024), threatening ING’s market position as customers who experience poor digital service rarely return (Accenture, 2025).

The GenAI Solution

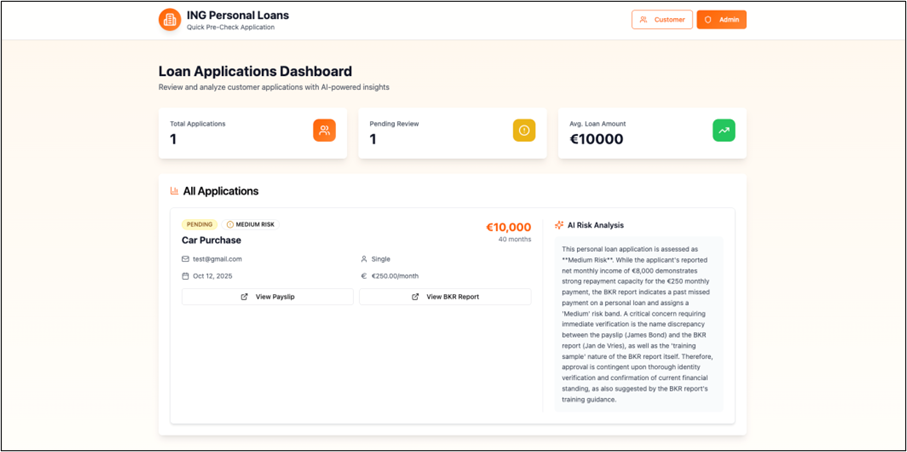

The proposed solution applies Generative AI to analyze unstructured financial documents while maintaining explainability and regulatory compliance. Using natural language processing (NLP), GenAI interprets payslips, invoices, and income records to generate standardized, transparent risk assessments (Al-Hchemi, 2024).

The three-stage process includes secure data ingestion, AI-driven document classification, and generative summarization that produces explainable risk profiles. Critically, humans remain in control, AI accelerates analysis without replacing judgment, ensuring full compliance with GDPR and the EU AI Act (European Parliament, 2023).

Transformative Impact

Processing time drops by 85%, from several weeks to just three days. Per-loan costs decrease 78%, from €450 to €100, as automation reduces manual work from eight hours to fifteen minutes (McKinsey & Company, 2023; Deloitte, 2019). Over three years, this transformation generates an estimated €700 million in cumulative revenue and €10.5–12.6 million in annual cost savings.

Beyond efficiency, AI-driven credit scoring enables 15–20% more approvals by fairly assessing self-employed individuals and those with limited credit histories (Fares et al., 2023). This expansion enhances financial inclusion while profitably serving previously underserved segments.

The model also demonstrates the economics of information goods (Shapiro & Varian, 1998): an upfront investment of €18–23 million yields dramatically lower marginal costs over time, creating sustainable competitive advantage through operational learning and scale.

Strategic Defense

A Business Model Canvas analysis (Osterwalder & Pigneur, 2010) reveals deep transformation across ING’s value structure, from automated key activities and AI partnerships to improved customer relationships, expanded target segments, and scalable cost economics.

Implementation challenges remain. Successful adoption requires robust change management (Gutzwiller et al., 2024), enhanced cybersecurity (FINMA, 2023), continuous bias audits, and strict adherence to evolving regulatory standards (Bank for International Settlements, 2021). Yet these challenges are outweighed by the strategic imperative to lead the AI transformation rather than react to it.

Conclusion

Integrating Generative AI is both technically feasible and strategically essential, fully aligned with ING’s Think Forward strategy. By embedding AI while retaining human oversight (Vial, 2019), ING can transform a core operational weakness into a durable competitive advantage.

The question is no longer whether AI will transform lending, it already is, but whether traditional banks will lead the transformation or be disrupted by it. ING possesses both the capability and the strategic imperative to choose leadership.

Team 22: Elias Stad 715336, Helen Hu 537226, Mihai Tulbure 765023, Vinita Ohm 787879

—

References

Accenture. (2025). Global banking consumer study 2025: Banking advocacy powering growth. https://www.accenture.com/us-en/insights/banking/consumer-study-banking-advocacy-powering-growth

Al-Hchemi, L. H. (2024). Evaluating Generative AI in enhancing banking services efficiency. Економічний Форум, 47–54. https://doi.org/10.62763/ef/4.2024.47

Bank for International Settlements. (2021). Artificial intelligence and machine learning in financial services. Basel Committee on Banking Supervision. https://www.bis.org/bcbs/publ/d537.pdf

De Nederlandsche Bank. (2024). Annual report 2024. https://www.dnb.nl/en/publications/publications-dnb/annual-report/annual-report-2024/

Deloitte. (2019). AI leaders in financial services: Common traits of frontrunners in the artificial intelligence race. https://www2.deloitte.com/us/en/insights/industry/financial-services/artificial-intelligence-ai-financial-services-frontrunners.html

European Parliament. (2023). EU AI Act: First regulation on artificial intelligence. https://www.europarl.europa.eu/topics/en/article/20230601STO93804/eu-ai-act-first-regulation-on-artificial-intelligence

Fares, O. H., Butt, I., & Lee, S. H. M. (2023). Utilization of artificial intelligence in the banking sector: A systematic literature review. Journal of Financial Services Marketing, 28(4), 835–852. https://doi.org/10.1057/s41264-022-00176-7

FINMA. (2023). FINMA Risk Monitor 2023. https://www.finma.ch/en/~/media/finma/dokumente/dokumentencenter/myfinma/finma-publikationen/risikomonitor/20231109-finma-risikomonitor-2023.pdf

Gutzwiller, E., Moutiq, N., & Pearce, M. (2024, June 14). Ensuring a successful transformation through non-IT change management. Deloitte. https://www.deloitte.com/ch/en/Industries/financial-services/blogs/navigating-tech-enabled-transformation-of-core-banking-processes-part-3.html

ING Groep N.V. (2024). Annual report 2024. https://www.ing.com/Investors/Investors/Financial-performance/Annual-reports.htm

McKinsey & Company. (2018). The lending revolution: How digital credit is changing banks from the inside. https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/the-lending-revolution-how-digital-credit-is-changing-banks-from-the-inside

McKinsey & Company. (2023). The state of AI in 2023: Generative AI’s breakout year. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2023-generative-ais-breakout-year

Osterwalder, A., & Pigneur, Y. (2010). Business model generation: A handbook for visionaries, game changers, and challengers. John Wiley & Sons.

Shapiro, C., & Varian, H. R. (1998). Information rules: A strategic guide to the network economy. Harvard Business School Press.

Vial, G. (2019). Understanding digital transformation: A review and a research agenda. The Journal of Strategic Information Systems, 28(2), 118–144. https://doi.org/10.1016/j.jsis.2019.01.003