As an individual user of online platforms you may not notice on your own, but companies are conducting experiments over and over again to get a better understanding of … You! This blogpost will introduce one of the methods how companies experiment and acquire more information about the effectivity of their own platform and how they should approach you.

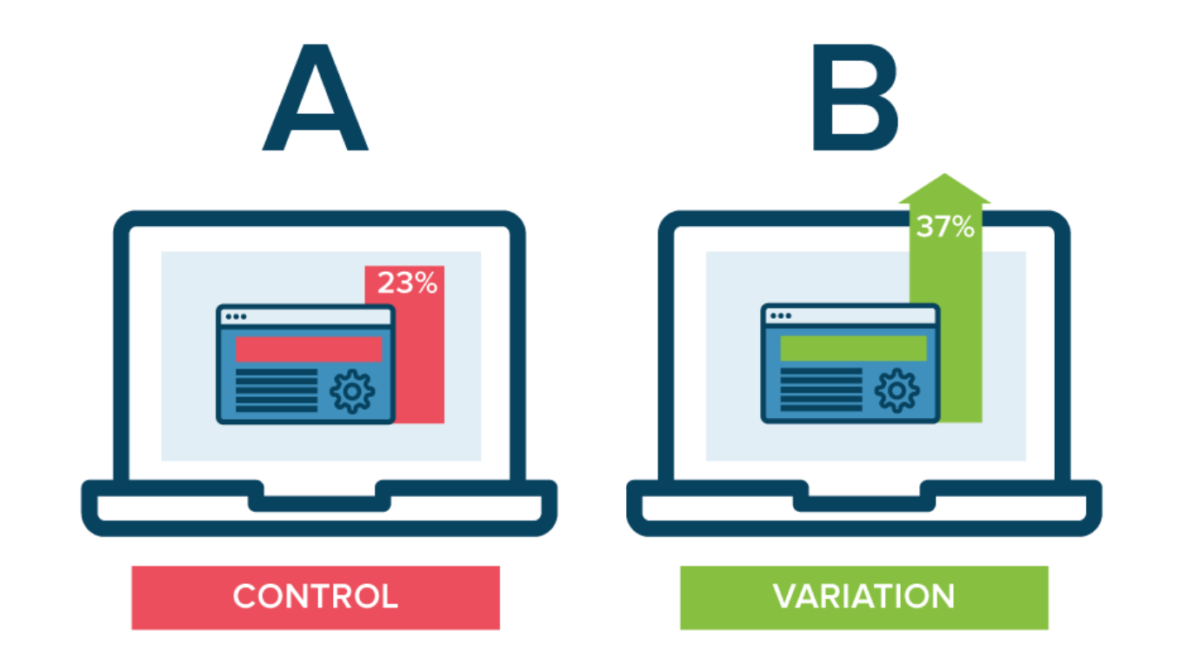

Bucket testing, also known as A/B testing or split testing, is a method of comparing two or more versions of a webpage, app or ad with each other in order to determine which one performs better. To give an example, imagine two variants of an ad. The former version is a video ad and the latter version a simple banner. By exposing users on a random basis to one of the two variants, companies can use statistical models to determine which ad performs better (e.g. measure the number of clicks). Facebook offers its platform for such practices, allowing companies to acquire data in the best way to reach their audience.

From a marketing perspective, bucket testing is a strong tool to gather information about the behaviour of an individual user through hypothesis testing. A user may be for instance more inclined to click on a certain object depending on the size, the colours or even its position on the webpage. For companies, this would mean that effective use of bucket testing leads to more exposure, as the ads are specifically tailored so that the audience is more likely to interact with it.

While bucket testing is not new phenomenon, it does raise some issues. A platform may become so powerful after thousands or millions of tests, that it can accurately leverage on people’s personal vulnerabilities, and influence an individual to take an action that may or may not be in his or her best interest. The possibility exists that we end up consuming information and adapting certain ideas without even knowing someone is pulling the strings. Platforms have thus become an additional tool to influence people in an effective manner.

Sources

https://www.facebook.com/business/help/290009911394576