Team 23: Dominik Grill (761539), Anca-Elena Macovei (777128), Matan Manzoor Koopman (598149), Yan Yan Sun (743349)

The Problem and Opportunity

In the current digital age customers expectations are constantly evolving at a fast pace. Research by McKinsey (2021) concluded that 71% of customers expect personalized interaction from the companies they purchase from. In addition, 76% of customers are frustrated when personalization is not provided (McKinsey, 2021). Currently, IKEA offers a post-sale experience that lacks active-interaction and personalized assistance. However, with IKEA’s previous digital and AI capabilities combined with their global digital hub, the company can leverage this to construct a GenerativeAI (GenAI) assistant chatbot into their app.

The Solution: GenAI Assembly Assistant Chatbot

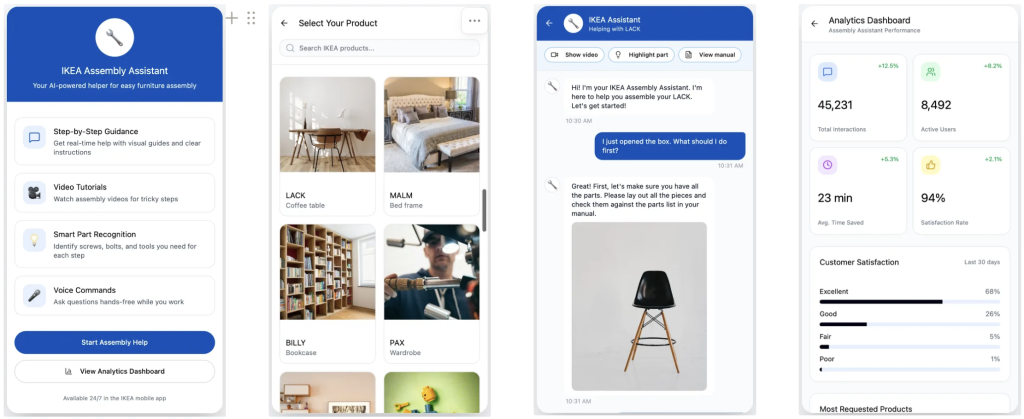

The proposed GenAI solution provides an extension to the famous assembly process IKEA is known for. Utilizing a chatbot interface in the current IKEA app allows customers to use text or voice to receive a step-by-step guidance to assemble the furniture. Moreover, the assistant provides visuals in the form of pictures and short videos with real-time responses to the user questions regarding the respective furniture. To eliminate false or misleading information, the system will employ Retrieval-Augmented Generation (RAG), ensuring that all outputs from the chatbot assistant are verified from IKEA’s manuals and databases. This further guarantees that all information is factual and accurate, causing less operational malfunctions. The solution goes beyond solely customer assembly guidance, it collects real-time insights from customers on where customers find difficulties and when the process is seamless, thus, helping IKEA improve its assembly process. The analytical offerings provide a neverending feedback loop bridging the customers experience with management.

Impact on IKEA’s Business Model

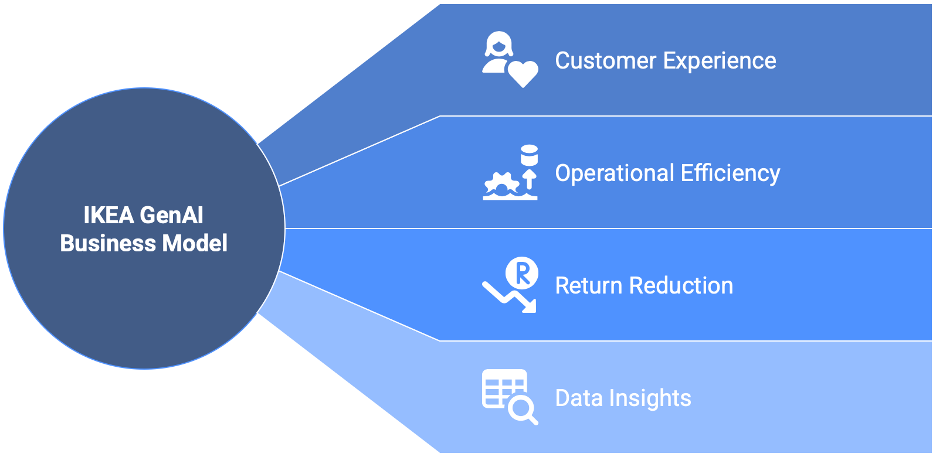

The GenAI chatbot assistant aims to strengthen IKEA’s current business model by proving the following four business processes as seen in Figure 1:

- Customer Experience is personalized, offering an interactive post-purchase experience increasing satisfaction.

- Operational Efficiency is achieved via automated assistance, thus reducing customer success costs.

- Return Reduction due to personalized instructions complemented by continuous help.

- Data Insights provided through the analytical dashboard presenting any customer difficulties in the assembly process.

Figure 1 IKEA Business Model

Challenges and Mitigation

Altering a business model using GenAI comes with its hurdles and risks. A few identified risks for IKEA’s chatbot assistant are AI hallucinations when using a large language model (LLM), data privacy of the user, and customer adoption barriers. Given the hurdles, the proposed mitigation strategies are building the system using RAG as a complementary to the LLM (ensuring the output is accurate and relevant), implementing a privacy-by-design approach, curating an intuitive user interface, and a multi-model architecture that discourages dependency on a single AI vendor.

Prototype

Figure 2 IKEA GenAI Chatbot Assistant

References:

McKinsey & Company. (2021). The Value of Getting Personalization right–or wrong–is Multiplying. Mckinsey & Company. https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying