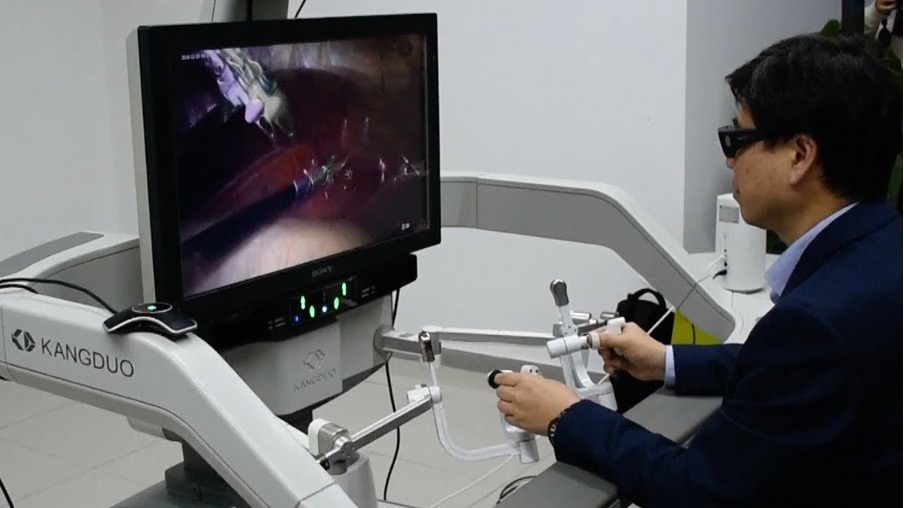

In 2019, Chinese Doctors managed to insert a stimulation device in the brain of a patient with Parkinson’s while the patient was 1900 miles away (Frost, 2019). The procedure was conducted using robotics, but it was truly made possible by 5G. 5G decreased the latency to near instantaneous, with only 2 milliseconds between devices, making it possible for the surgeons to have the procedure as if they were in the very same room. This blog post will delve into the potential benefits of remote surgeries, as well as the limitations that must be overcome.

The primary benefits of the technological application, over the standard in-person procedure, are cost benefits, timely access, and quality of medical training. As Frost (2019) explicates, the ability for a surgeon to conduct remote surgeries means that their utility increases. Whereas beforehand they were constrained by their location, specialists can now perform surgeries from one location, with their patients being at completely other locations. Instead of having to pick and choose which patient to perform surgery on, the surgeon can now cure more patients because they do not have to waste time on travelling. By increasing surgeon’s utility, costs decrease and more importantly, more lives can be saved.

Expanding on this, imagine a scenario where a patient is rushed into the hospital with severe brain hemorrhaging. However, he cannot be treated because the specialist is miles away. Using 5G, a remote surgeon could save the patient’s life by operating very quickly. Timely access is key in successful surgeries (Marrick, 2017), and 5G remote surgeries enable this.

Lastly, a primary benefit of remote surgeries is improved medical training (Cahill, 2017). Specialists can demonstrate their techniques live to a class remotely, and answer questions along the way. This is more insightful than a lecture, and more interactive than a video demonstration. Hence, quality of education can be improved.

Although remote surgeries certainly have a promising future in the Healthcare industry, there currently exist limitations preventing normalization. First, there are still risks of high latency, which have a detrimental impact on surgical performance (Cahill, 2017). Hence, a more stable 5G network needs to be established before 5G remote surgeries can truly take off. Secondly, costs of remote surgical equipment are significantly larger compared to the standard surgery procedures. Nevertheless, the expectation is that costs will drop rapidly following innovations (Cahill, 2017). In addition, it is worth noting that the additional costs could well be worth it if they end up saving additional lives. Ultimately, it is unlikely that surgeons will ever have a stay at home job, as the medical equipment necessitated for remote 5G surgeries is far too complex. However, it seems like only a matter of time until remote surgeries will become prevalent in healthcare, to the great benefit of patients, and medical students.

References

Cahill, D. J. (2017). Telesurgery: Surgery in the Digital Age. DARTMOUTH UNDERGRADUATE JOURNAL OF SCIENCE, 19(3). https://digitalcommons.dartmouth.edu/cgi/viewcontent.cgi?article=1002&context=dujs

Frost, C. (2019, August 16). 5G is being used to perform remote surgery from thousands of miles away, and it could transform the healthcare industry. Business Insider. https://www.businessinsider.nl/5g-surgery-could-transform-healthcare-industry-2019-8?international=true&r=US

Marrick. (2017, May 2). 4 Reasons why Timely Medical Treatment is Important after an Accident. Marrick Medical. https://www.marrick.com/timely-medical-treatment/