I am fascinated by the idea of information goods – firstly introduced during the start of the 1950s, they prevail to be an incredibly profitable and state of the art product type.1 My fascination arises from the impressive difference between information and physical goods. If the gap between information goods and the next product type is equally big or even larger, which products could we think of?

Imagine, all a person knows is physical goods – the world hasn’t developed non-object (information) goods yet. This fictitious individual is used to buy products, which need to be newly produced, whenever an item is ordered. Additionally, personalizing a product takes a lot of extra work, as the product needs to be adjusted physically, by steps in a manufacturing process not being standardized. Ultimately, the product will break down sooner or later. Telling this person, that there will be another kind of product, being transformable and customizable easily, without any massive extra costs, would leave this person stunning. Further, explaining that the product could be reproduced an unlimited amount of time, without any significant additional cost as well, and that this product wouldn’t be subject to wear and tear over time, would sound unimaginable for this person. This whole process left me thinking: How could the next tremendous product development look like?

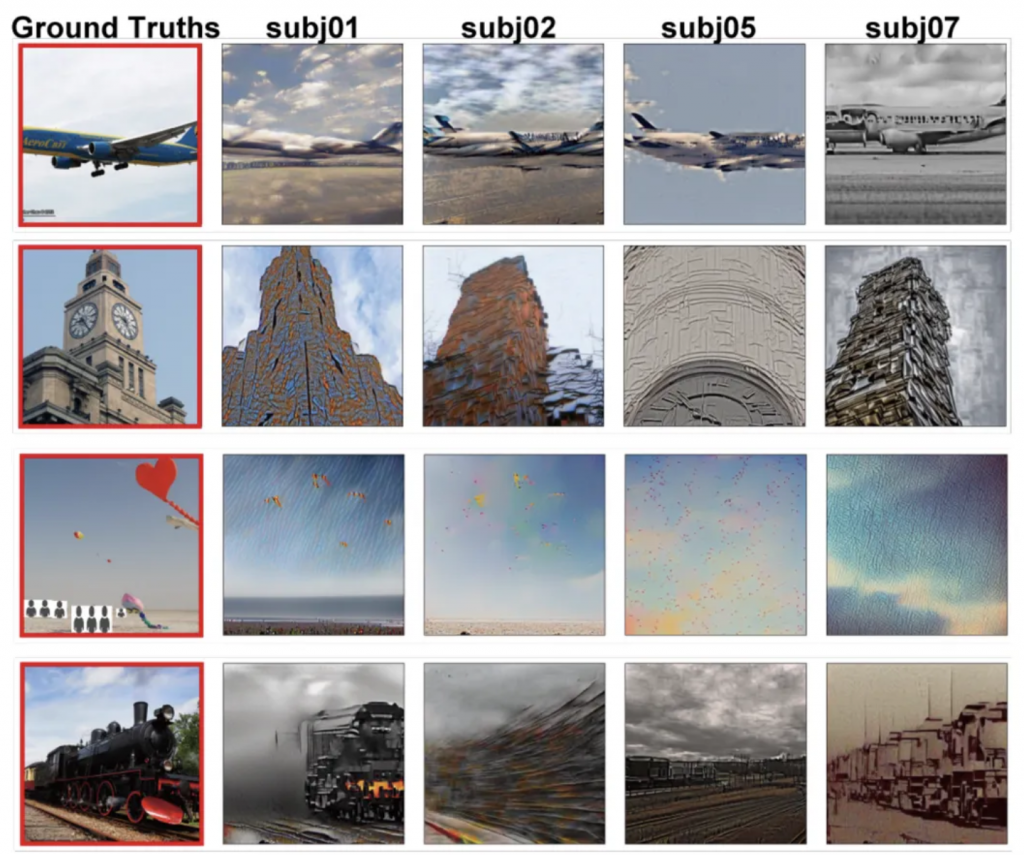

Upcoming trends show that this could be cognitive or even neurological goods. In my understanding, both enable physical or knowledge enhancements to be directly bought. On the one hand, cognitive goods would include obtaining knowledge, being entailed in a book, directly (without reading the actual book), by buying and transferring it. Neuralink, for instance, tries to develop enhanced communication between the brain and computers.2 Accelerating this communication to real-time speed, would enable a market for cognitive goods. On the other hand, neurological goods could include all types of physical capabilities. This could not only be skills, which otherwise would need to be learnt over time (e.g., playing the piano), but also those, which can not be learnt anymore, for example because of paralyzation (e.g., walking even though being paraplegic). The precision, with which neuronal activity can be surveilled, replicated, and even stimulated, becomes comprehensible, when considering experiments such as the one of Takagi and Nishimoto (2022), in which they tried to measure neuronal activity of people seeing things, in order to replicate the objects they have seen.3 The results, visualized in the graphic, should leave us stunning and maybe realizing that a market for neurological as well as cognitive goods is not too far away anymore.

- Timothy Williamson (2023). History of computers: A brief timeline. Retrieved from: https://www.livescience.com/20718-computer-history.html ↩︎

- Ben Kendal (2024). Was wollen Neuralink und Musk mit ihrem Gehirnchip erreichen – und ist er überhaupt sicher? Retrieved from: https://www.rnd.de/wissen/neuralink-was-ist-das-und-was-will-elon-musk-mit-dem-chip-im-gehirn-erreichen-ZFEHGH2WDVDZ3AGVYXP6OOWYU4.html#; https://neuralink.com ↩︎

- Sarah Kuta (2023). This A.I. Used Brain Scans to Recreate Images People Saw. In: Smithsonian Magazine, retrieved from: https://www.smithsonianmag.com/smart-news/this-ai-used-brain-scans-to-recreate-images-people-saw-180981768/ ↩︎